Moody’s DataHub is a cloud-based data delivery platform that combines innovative technology with industry- leading analytic tools to transform the data experience end-to-end. Beginning with your initial data evaluation through to the final data delivery, DataHub reduces the time and resources you need to fuel your decision making.

What is DataHub?

Transforming the data experience

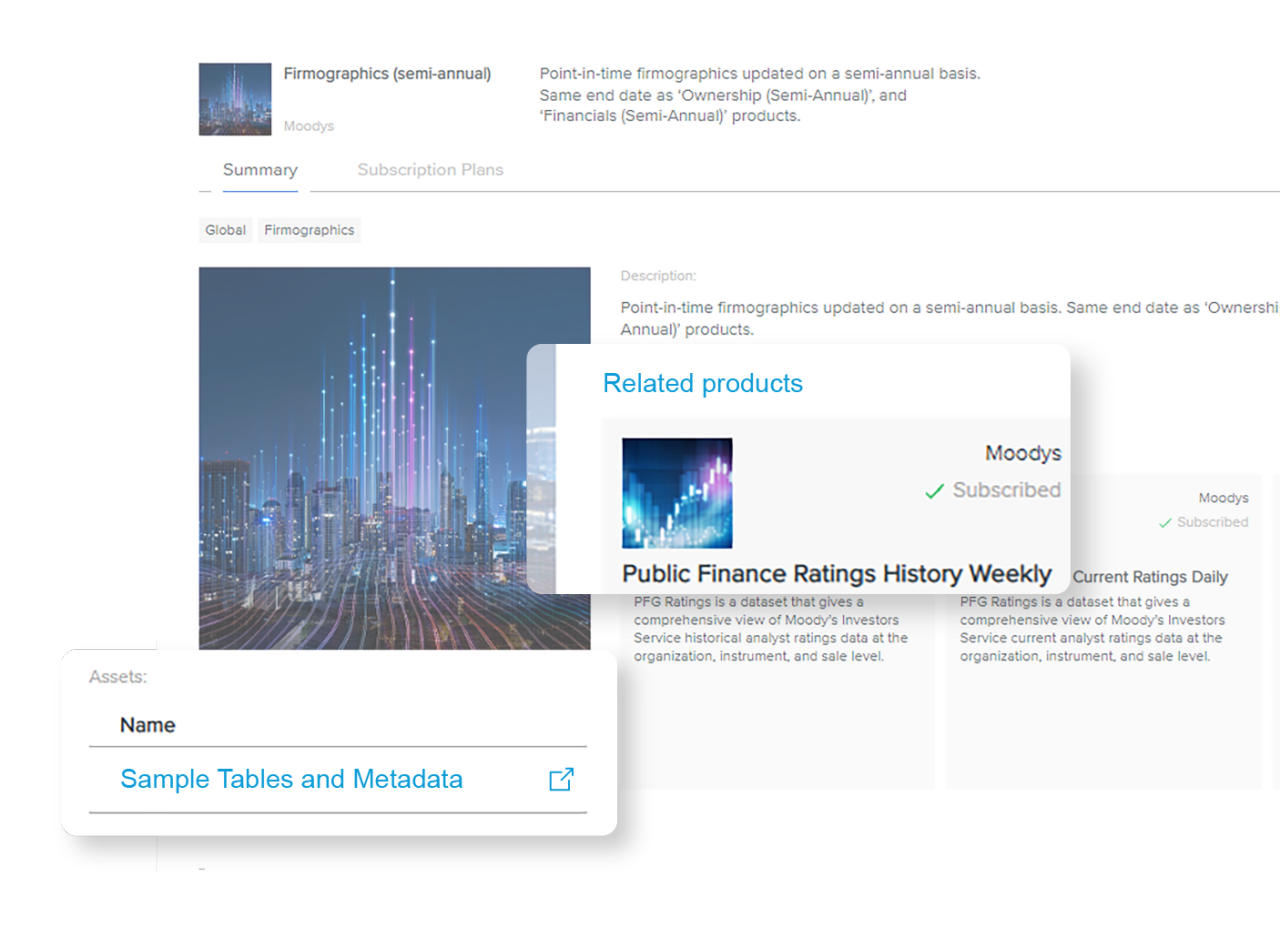

Try before you buy

Review sample data, explore data glossaries, and discover complementary data to inform your needs.

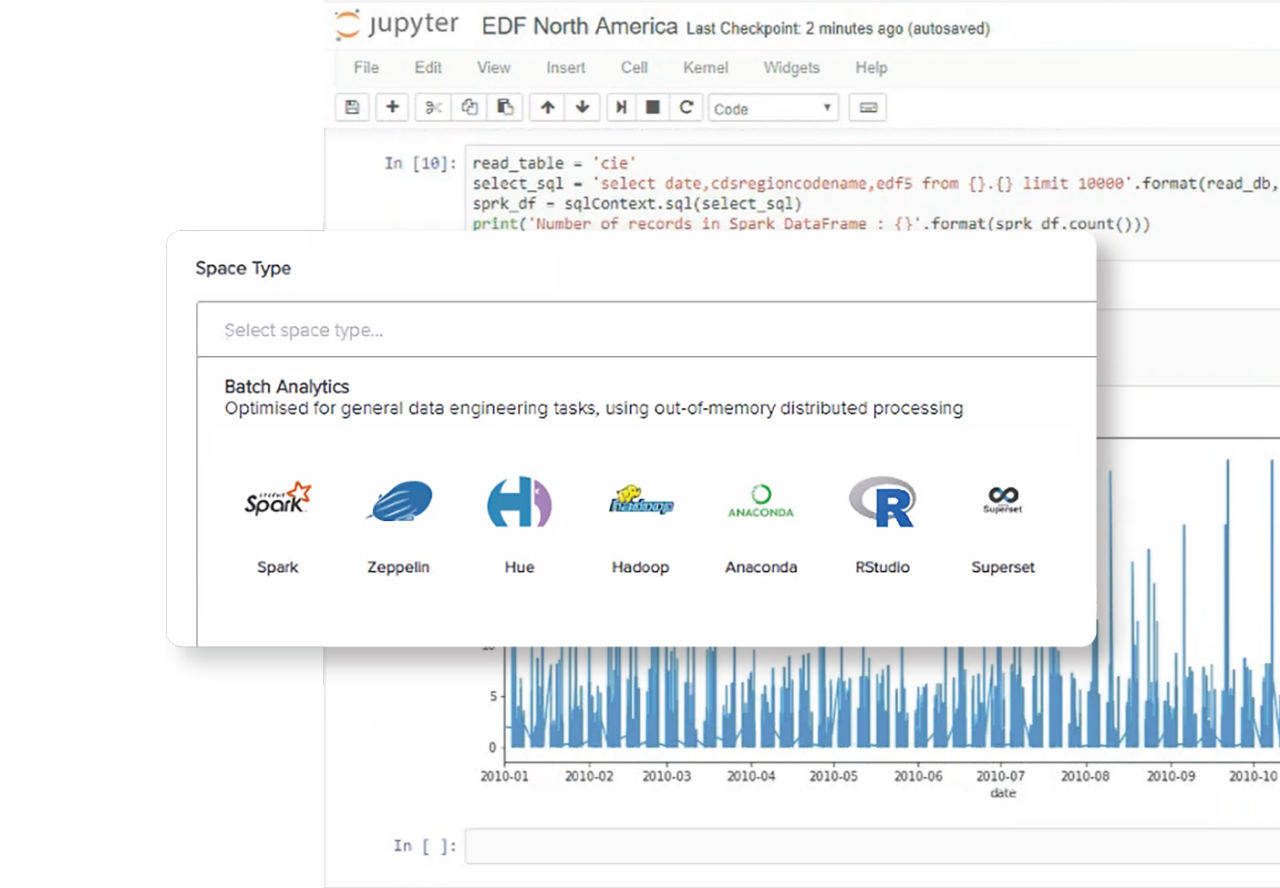

Access industry-standard data science tools

Use analytics tools and pre-populated workbooks to evaluate and query data in secure workspaces without having to bring the data in-house.

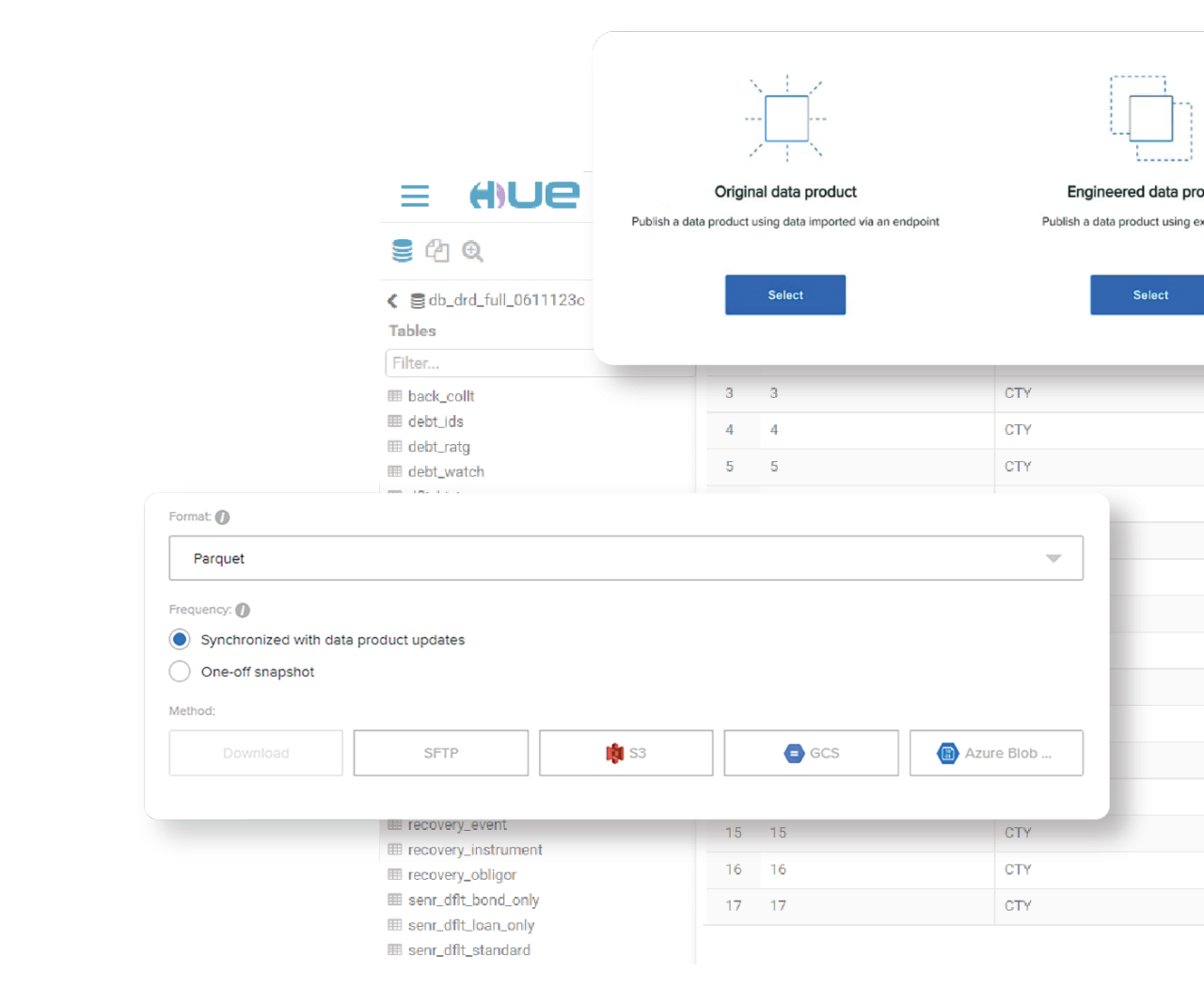

Build the data you want, the way you want it

Upload your own proprietary data and/or combine Moody's data sets to create custom data products.

Export data in several industry-standard formats, then choose the delivery and scheduling options you prefer.

Access our many award-winning data sets

Convert raw data into decisions through a single interface, without burdening your internal resources.

450 million

public and private entities available through our award-winning Orbis database

4.5+ million

current and historical ratings from Moody's Investors Service in Moody's Analytics Risk Data Suite

17 million

commercial real estate properties covered by Moody's ESG physical climate risk data

TOOLS TO BUILD WHAT YOU WANT

Latest Resources

Discover how data interoperability enabled platforms are driving financial services.

Take a deep dive

Watch our webinar to learn how DataHub's workflows and versatility enable you to get to actionable data faster.

Learn how Deloitte leveraged DataHub to gain data efficiencies to power their M&A Sensing solution.

Learn how DataHub empowers you to create unique data products tailored to your specific needs.

Recognition